ICO Coffee Market Summary Report – February 2024

Overview:

The following report presents a comprehensive summary analysis of the global coffee market based on data from various sources, including the International Coffee Organization (ICO) and market reports.

The report delves into key indicators such as price trends, export figures, production, and consumption patterns, providing valuable insights for stakeholders in the coffee industry.

African Coffee Exports: January 2024 and Coffee Year 2023/24 Overview

In January 2024, the exports of all forms of coffee from Africa experienced a notable increase of 6.5%, totaling 1.02 million bags compared to 0.96 million bags in January 2023. This growth marks a positive trend for the region’s coffee export sector.

January 2024 Performance:

– Overall Increase:The total export volume surged by 6.5% in January 2024, demonstrating resilience and potential growth in the African coffee market.

– Ethiopia’s Contribution: Ethiopia emerged as the primary contributor to the region’s increased exports, with a remarkable surge of 159.5%. Ethiopia’s own exports escalated from 0.1 million bags in January 2023 to 0.24 million bags in January 2024.

Factors Driving Growth:

– Normalization of Market Circumstances: The substantial increase in Ethiopian exports reflects a favorable base effect and a comparative normalization of market circumstances. This normalization likely stems from resolving contract disputes that emerged due to a mismatch between local purchasing prices and global market prices at the beginning of 2023.

– Resolution of Disputes: The disputes, which had been impacting export volumes since the start of 2023, have seemingly been resolved. As a result, there has been a significant rebound in exports, indicating restored confidence and stability in the market.

Coffee Year 2023/24 Overview:

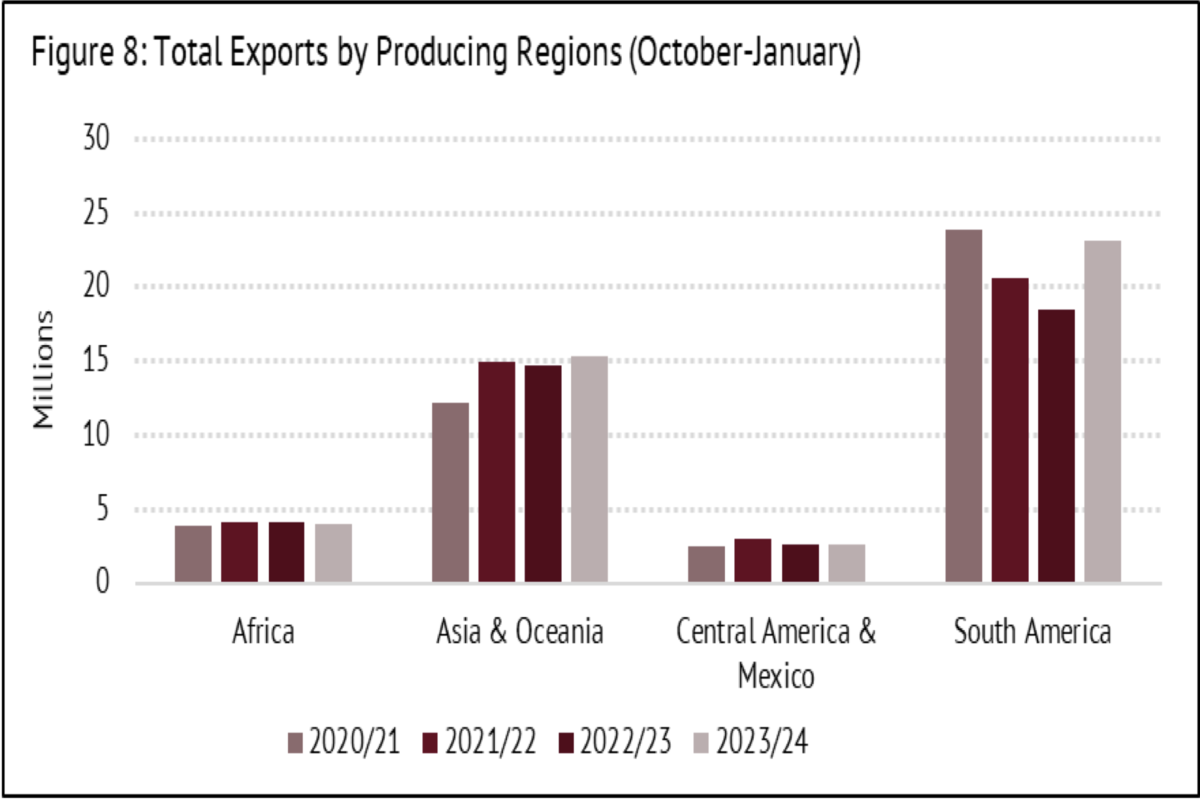

– Total Export Volume:Despite the positive performance in January 2024, the total exports for the first four months of coffee year 2023/24 amounted to 4.08 million bags, down by 1.7% compared to the same period in coffee year 2022/23.

– Impact of Disputes:The challenges posed by contract disputes affected export volumes, leading to a decline in total exports for the current coffee year. However, the resolution of these disputes has likely set the stage for improved performance in the coming months.

The increase in African coffee exports in January 2024, particularly driven by Ethiopia, reflects a positive turnaround for the region’s coffee market. The resolution of contract disputes has played a pivotal role in normalizing export activities, contributing to the rebound in export volumes.

As the market stabilizes, there is potential for continued growth and resurgence in African coffee exports in the upcoming months of coffee year 2023/24.

Global Coffee Market Performance: January 2024 Overview

London Certified Stocks:

– The London certified stocks experienced a significant decline, retracting by 16.8% to 0.40 million 60-kg bags. This figure represents one of the lowest levels since January 2014.

– Certified stocks of Arabica coffee saw a notable increase, reaching 0.35 million 60-kg bags, marking a 28.5% rise since January 2024.

Global Green Bean Exports:

– In January 2024, global green bean exports surged to 11.55 million bags, showcasing a substantial increase of 35.8% compared to the same month of the previous year.

Coffee Forms:

– Total exports of soluble coffee grew modestly by 2.7% in January 2024 to 1.01 million bags compared to January 2023. Soluble coffee’s share in the total exports of all forms of coffee for the year to date was 8.0% in January 2024.

– Exports of roasted beans also increased by 7.6% in January 2024 to 59,851 bags.

Price Trends and Market Indicators:

– The ICO Composite Indicator Price (I-CIP) averaged 182.04 US cents/lb in February 2024, marking a 3.2% increase from January 2023.

– The I-CIP exhibited steady growth in February 2024, reaching a 17-month high, reflecting upward momentum in coffee prices.

– Notable price increases were observed in Colombian Milds, Other Milds, and Robustas, with the latter reaching its highest level in almost 30 years.

– The Colombian Milds–Other Milds differential contracted significantly, indicating a narrowing arbitrage between these coffee types.

– Intra-day volatility of the I-CIP declined, suggesting increased stability in coffee prices.

Export Trends:

– Global green bean exports surged by 35.8% in January 2024 compared to the same period last year, reaching 11.55 million bags.

– South America and Asia & Oceania witnessed substantial export growth, with Brazil and Vietnam driving the positive trends, respectively.

– Notable increases were also observed in exports of Other Milds, Brazilian Naturals, and Robustas.

– Conversely, exports from Mexico & Central America experienced a decline, primarily attributed to decreased shipments from Honduras.

Production and Consumption:

– World coffee production marginally increased by 0.1% in coffee year 2022/23, with significant regional variations.

– The Americas, particularly Brazil, drove production growth, offsetting declines in Asia & Oceania and Africa.

– Coffee consumption faced challenges amidst the COVID-19 pandemic, recording a decrease of 2.0% in coffee year 2022/23.

– However, a rebound in consumption is anticipated for coffee year 2023/24, with an expected growth of 2.2% to 177.0 million bags.

Outlook:

– Coffee production is forecasted to increase by 5.8% in coffee year 2023/24, driven by favorable conditions in the Americas.

– The outlook for coffee consumption remains positive, supported by economic growth and stock drawdowns.

– Despite challenges, the world coffee market is expected to run a surplus of 1.0 million bags in coffee year 2023/24.

Conclusion:

The report provides a comprehensive summary overview of the global coffee market, highlighting price trends, export dynamics, production, and consumption patterns.

The analysis underscores the resilience of the coffee industry amidst challenges, with promising prospects for future growth.

These insights are valuable for industry stakeholders to navigate market dynamics and capitalize on emerging opportunities.

Complete report can be accessed via the following link : https://www.icocoffee.org/documents/cy2023-24/cmr-0224-e.pdf